AMP solutions

OverView

Cloud Banking ‘AMP’

“AMP” is based on experiences of the banking system operating in 13 countries around the world, including the US, UK, and Asia based on a one-source operation performance. AMP is a cloud banking software solution jointly developed by Korea and Japan by applying the latest IT technologies such as Cloud, Micro Service, and OpenAPI.

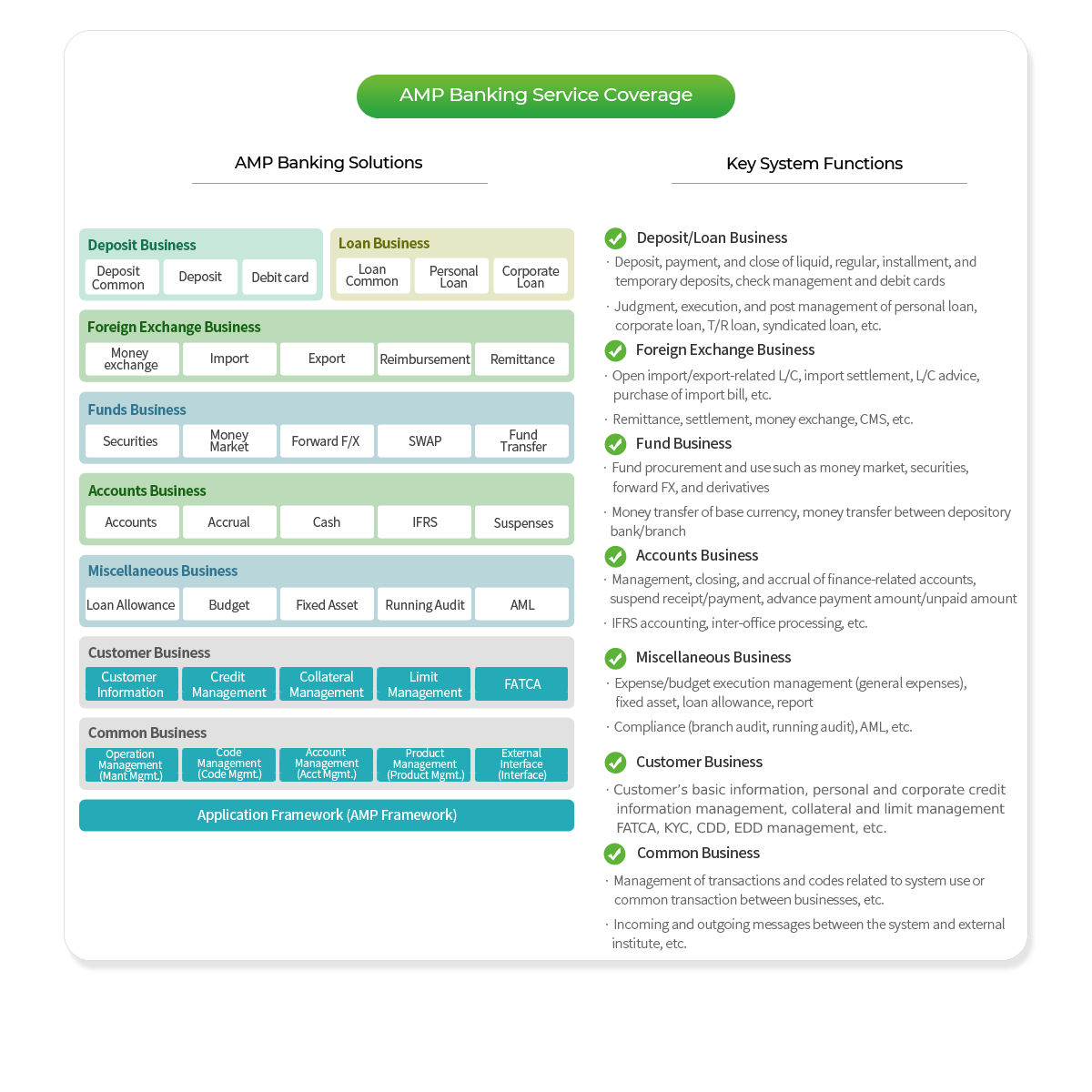

Covering all systems including personal, corporate, international core banking and foreign exchange, it faithfully responds to multiple regulations such as AML, FATCA, and IFRS from a global perspective. From technological aspect, AMP realizes high flexibility and extensibility developed by latest architectures such as Pure JAVA, complete separation of our own Framework (AMP-Framework) and business applications, various parameters and rule base application, moduled application by function (Component) , cloud technology and API linkage etc.

Moreover, only necessary functions can be implemented and prior checking is available through demos or trial version. About the functions of the application, it can be customized freely by the customer as we provide source code (with modification rights), related documents and technology transfer to customers. AMP is the most suitable solution for user-driven customizing and development in an Agile manner. Payment for license is done through a subscription which varies depending on the client’s country or field. Users may start on a small scale and expand the functions according to their needs.

A system capable of responding quickly and flexibly to the business environment

The banking solution has the power to respond immediately to requests such as policy changes, non-face-to-face transanctions, digital and local currencies, fee revisions, digital bank accounts, and paperless. Based on the fusion of advanced financial and IT know-hows, AMP can handle wide range of works for Neobank, SaaS, BaaS, restructures including foreign exchange and overseas works. This is a new-generation Core Banking System that is incomparable to its predecessors, considering its performance, delivery method, and coverage of services.

Maintenance through high-tech architecture (Laborsaving)

As a customer/product-centric data model, it applies the customer’s unified management and rule/parameter-based product management system to allow application of new products and services quickly without program modification. Moreover, various business needs can be met through its multi response capabilities (Multi-Country/Bank/Currency/Accounting(IFRS)/Language). Various masters and codes in the system infrastructure and operation, registration and management of the languages used, etc., are established as rules/parameters to improve the efficiency of system operation.

Broad business response, staged system introduction

It not only provides general banking features such as deposits and loans for domestic and overseas personal/corporate customers, but debit card business, foreign exchange business, trade (export/import, trade finance, foreign currency settlement), syndicated loan, and money management (securities, money market, SWAP, foreign exchange futures) are also provided. On top of that, it also covers internal audit, AML, FATCA, and IFRS. You can choose only the necessary tasks among such a wide range of services to start as a small size and expand your business functions and systems along with the expansion of your business needs in the future.

Strong support for insourcing

Lately, many firms prefer 「Insourcing development」. From a mid to long term perspective, core banking systems are no exceptions to this trend. AMP provides technology transfer and rights to change on all programs except for Framework functions. AMP also offers a set of development kit including development guides and development-related training, to support customer (or customer-designated IT company) driven insourcing when it's necessary. We'd like to recommend customers check the functions first based on the trial version, and then complete the system while developing in Aglie manner as the need arises, learning the know-hows of the system, and training staffs. For example, there was a beginner JAVA user who, after a week of training, was able to edit and develop the program successfully.

Superior Global Banking System

Led by FinTech, the importance of responding against various digital and electronic currencies is emphasized more than ever. AMP’s architecture is optimized for any global response within the financial sector. Moreover, multi-currency, multi-language, and digital currency needs can be met through the multi response capabilities (Multi-Country/Bank/Currency/Accounting(IFRS)/Language). Check the demo and trial version and see how superior our product is compared to similar products in a banking solution for global development.

Faithful compliance response

Responsiveness against regulations has been increasing from various perspectives. However, more functionalities are being required due to reinforced internal rules and newly added rules such as ESG response and internal rule against financial monopoly. In particular, KYC, AML, and FATCA responses have already become mandatory, and IFRS responses are also required for global deployment. There are many compliance features prepared in AMP such as AML and FATCA. After confirming the corresponding functions in the demo, please review the additional responses of ESG or other compliances (e.g., My Number card in Japan) in the system expansion plan.

Flexible operation environment and verified track record

AMP reflects the cloud native directory of the architecture and supports the operation environments personalized to customer needs from public cloud (AWS, Azure, etc.) to on-premise configuration. It has multiple track records in Japan where high stability, reliability, and durability are critical. Also, the global banking system operates in 10 countries, including the US, Japan, China, and Southeast Asia, and the global microfinance system is in operation in two countries including Indonesia and Laos.